Rose AI

Are you ready to experience the power of artificial intelligence? Introducing Rose AI, the cutting-edge technology that is revolutionizing the

Are you curious about how certain financial decisions could impact your credit score? Want to easily navigate the world of credit and get personalized recommendations on how to improve your financial standing?

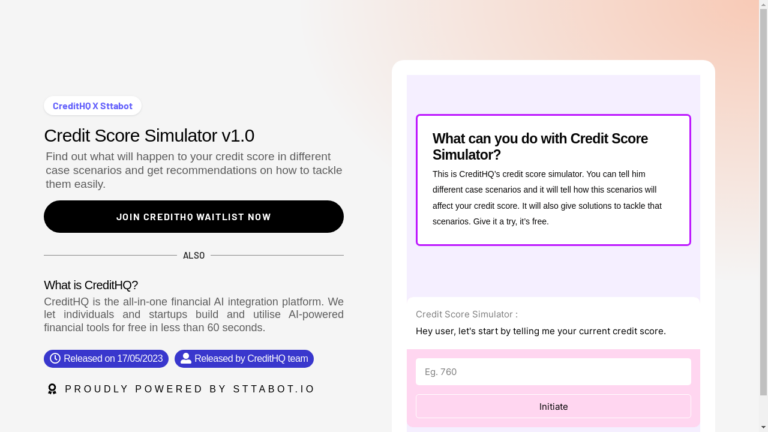

Look no further than CreditHQ X Sttabot Credit Score Simulator v1.0!

With CreditHQ, you can unlock the power of AI to gain insights into your credit score and make informed financial decisions. Whether you’re an individual looking to build your credit or a startup seeking financial stability, CreditHQ has you covered.

In less than 60 seconds, you can access AI-powered financial tools for free and take control of your financial future.

So, what exactly does CreditHQ offer? Let’s dive into the features and benefits that make this tool a game-changer in the world of credit management.

One of the standout features of CreditHQ is its Credit Score Simulator. This innovative tool allows you to explore different case scenarios and see how they could impact your credit score.

Wondering what would happen if you missed a payment or took out a new loan? The Credit Score Simulator can provide you with real-time feedback, giving you a clear understanding of how your financial decisions may affect your creditworthiness.

By using the Credit Score Simulator, you can confidently navigate the complexities of credit and make informed choices that align with your financial goals. Whether you’re aiming to improve your credit score or maintain your current standing, this feature is a valuable asset.

Another impressive aspect of CreditHQ is its ability to provide personalized recommendations based on your credit score and financial profile. The AI integration analyzes your data and offers tailored suggestions to help you tackle any credit-related challenges you may be facing.

From debt management strategies to optimizing your credit utilization ratio, CreditHQ’s recommendations are designed to empower you to take control of your financial health. Say goodbye to generic advice and hello to personalized guidance that caters to your unique financial situation.

CreditHQ prides itself on its user-friendly interface and quick integration process. Within just 60 seconds, you can sign up and start utilizing the power of AI to enhance your financial decision-making.

This seamless integration makes CreditHQ accessible to individuals and startups alike, allowing you to harness the power of AI without any technical barriers.

Whether you’re a tech-savvy user or a complete novice, CreditHQ’s intuitive platform ensures that you can effortlessly navigate its features and make the most of its capabilities. No lengthy setup processes or complex configurations – just a simple and straightforward experience.

Perhaps one of the most enticing features of CreditHQ is the fact that it offers free access to AI-powered financial tools. This democratization of AI technology allows individuals and startups to leverage advanced financial analytics without incurring any costs.

By providing free access to AI-powered tools, CreditHQ aims to level the playing field and empower users from all walks of life to make informed financial decisions. Whether you’re an individual looking to improve your credit score or a startup seeking to optimize your financial strategies, CreditHQ’s commitment to accessibility ensures that everyone can benefit from the power of AI.

Now that you’re familiar with the key features of CreditHQ, you may be wondering about its pricing models and plans. Let’s dive into that next.

Unfortunately, the provided content does not mention any pricing information for CreditHQ. However, rest assured that CreditHQ offers a range of plans to cater to different needs and budgets.

Whether you’re a budget-conscious individual or a growing startup, CreditHQ has pricing options designed to suit your requirements. Visit their website to explore the available plans and choose the one that aligns with your goals.

Now, let’s address some common questions that potential users may have about CreditHQ.

A: Absolutely! CreditHQ takes data security seriously and employs robust measures to protect your personal information.

Your data is encrypted and stored securely, ensuring that your privacy is safeguarded at all times.

A: Yes! CreditHQ’s AI-powered tools and personalized recommendations are specifically designed to help you improve your credit score. By providing insights into your creditworthiness and offering tailored strategies, CreditHQ empowers you to take the necessary steps to enhance your financial standing.

A: The Credit Score Simulator is updated in real-time, ensuring that you have the most accurate information at your fingertips. You can trust that the simulations provided by CreditHQ are based on the latest credit scoring algorithms and industry standards.

Now that we’ve addressed some common questions, let’s wrap up with a brief conclusion.

CreditHQ X Sttabot Credit Score Simulator v1.0 is a powerful tool that harnesses the capabilities of AI to provide individuals and startups with invaluable insights into their credit scores. With features like the Credit Score Simulator and personalized recommendations, CreditHQ empowers users to make informed financial decisions and take control of their financial health.

By offering free access to AI-powered financial tools and ensuring a quick and easy integration process, CreditHQ ensures that users from all backgrounds can benefit from the power of AI without any barriers. While pricing information was not mentioned in the provided content, CreditHQ offers various pricing plans to cater to different needs and budgets.

Whether you’re looking to improve your credit score, optimize your financial strategies, or simply gain.

Are you ready to experience the power of artificial intelligence? Introducing Rose AI, the cutting-edge technology that is revolutionizing the

Are you tired of dealing with the hassle of credit card payments? Do you want a faster, more streamlined way

Are you looking for a reliable and efficient AI-powered identity verification tool? Look no further, as Shufti Pro has got

Are you an investor looking for accurate and verified data on public companies? Look no further! FinChat is here to

Are you tired of spending valuable time and resources on tedious and error-prone order processing tasks? Look no further! Workist

Are you tired of endlessly scrolling through news articles and websites trying to find the latest updates on your favorite

❌ Please Login to Bookmark!